BUDGET COMMITTEE

NOTE: All data graphs, tables and charts were created by the Rye Civic League. Schedule frameworks are from the budget committee.

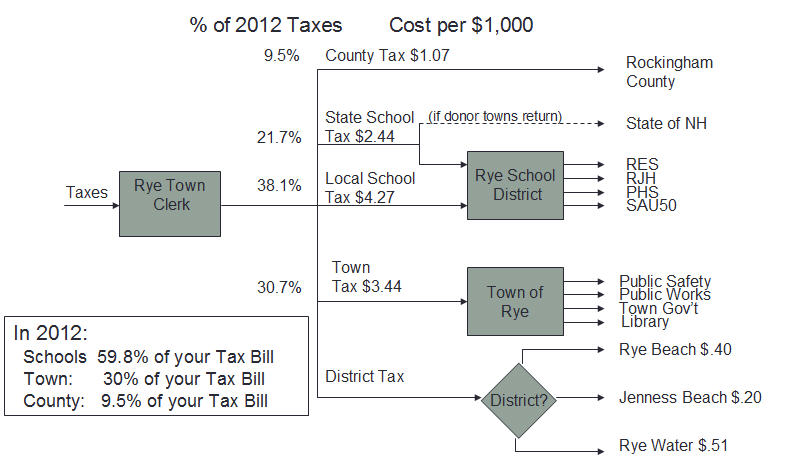

Residents of Rye contribute to multiple entities that raise funds through taxes. These groups are all independent. These groups are the Rye Town Government, Schools, Water District, Rye Beach District, Jenness Beach District and Rockingham County.

The Rye Budget Committee is responsible for establishing each year’s operating budget for the Town, the Water District and the two Precincts: Jenness Beach and Rye Beach. The Rye Library and Cemetery funds are collected by the town but are managed by independent boards.

The Budget Committee consists of six members-at-large, each of whom is elected to a three-year term. The terms of the members-at-large are staggered so that not all are up for re-election the same year. There are also five appointed members, representing the Board of Selectmen, the School Board, the Jenness Beach District, the Rye Water District and the Rye Beach Precinct. There is also an alternate Rye Water District Representative. Residents may contact the Chairman of the Budget Committee or any of the individual members with questions or comments. Contact information for the Budget Committee is available on the Rye website. The Budget Committee meets according to the annual calendar established by the Committee at the beginning of each annual budgeting cycle. That schedule includes budget work sessions, Public Hearings, Quarterly Budget Review of both Town and School Budgets and other meetings based upon forecasted need. The meetings are held in the Court Room at Town Hall, the Town Library or the Rye Junior High School Library. The dates and times of the work sessions and Public Hearings are posted. Each meeting agenda is posted at least a week in advance. The time to get involved in the budget process is early.

The Rye Budget Committee’s duties are outlined in RSA 32:5. The current members of the Rye Budget Committee are Raymond Jarvis (2015), Douglas Abrams (2015), Shawn Crapo (2016), James Maheras (2016), Paul E. Goldman , Chair (2014), Edward “Ned†Paul, III (2014), Jeanne Moynahan (School Representative), John Murtagh (Water District Representative), and Craig N, Musselman (Selectmen’s Representative) (2015).

The Town budget process starts with meetings between the department heads and the Town Administrator to develop the departmental budgets. The Town Administrator then approves or adjusts those budgets and submits them to the Board of Selectmen. The Selectmen approve or revise the departmental budgets and send the statement of proposed expenditures and revenues for the following year to the Budget Committee. The Budget Committee holds work sessions with the Town Administrator, Board of Selectmen, and Department Heads to review the departmental budgets and anticipated revenues for the following year. The Budget Committee can support or modify the departmental budgetary recommendations.

At the end of this process, the Budget Committee considers all of the input they have received and sets the operating budget figure and estimated revenues, and submits them to a Public Hearing and then to the Deliberative Session.            The Budget Committee is required by statute to hold a Public Hearing on the proposed operating budget not more than twenty five days before the Deliberative Session and  before  the  operating  budget  is  finalized  for  the  ballot.  In  addition,  the Committee      reviews   any special money                  Warrant Articles        proposed            by          the Selectmen or the public and will “recommend†or “not recommend†them to the Public Hearing.

| Time Frame | Activity |

| October | Work Sessions with Town Department Heads |

| December | School Work  Sessions |

| December | Town Work  Sessions capital outlays, CapitalReserves and Warrant Articles |

| January | Public Hearing  School Budget |

| January | Public Hearing  Town Budget |

| February | Deliberative Town Meeting |

| February | School Deliberative Town Meeting |

| February | Precincts work  session and public hearings |

Similarly, The Rye School Board establishes the school budget and the Rye Budget Committee reviews the Rye school budget and votes to “recommend†or “not recommendâ€. The process begins with the school staff requisition for appropriations to be included in the proposed budget. The Building Principals meet with the Superintendent of Schools, Assistant Superintendent, Special Education Director and Business Administrator to review the budgetary requests, including special education appropriations. The administrative team collaboratively prepares the preliminary proposed budget document which is presented to the School Board for its review and vote. The Board also reviews Warrant Articles to determine whether to recommend or not recommend the Articles. The Board also prepares a default budget in accordance with RSA 40:13.

The School Budget Calendar consists of these steps. Citizens can be involved from the beginning phases of this process

| Time Frame | Activity |

| September/October | Administrators create budget with  staff input |

| October/November | SAU50 Business Administrator and Superintendentreview the budget |

| November | SAU50 School  Board members approvethe SAU50 budget. |

| November | School Board  addresses the budget as part of the monthly school board meeting |

| December | SAU50 Budget  Public Hearing |

| December | Rye School  Board will discuss budget at the Monthlymeeting |

| December | Budget Committee decides on the wording for theirbudget recommendation |

| January | Public Hearing  on School budget  prior toDeliberative meeting |

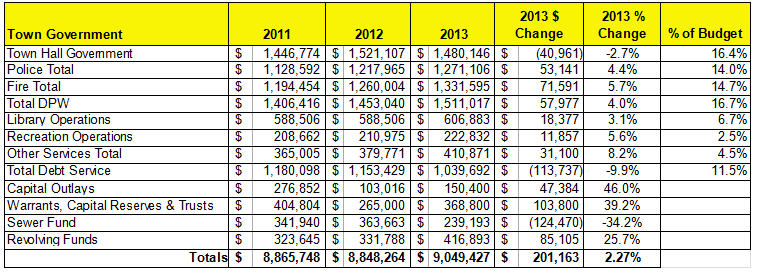

Town Government. Table A shows the elements of town government.

Table A

The Library is shown on the table but is managed by the elected Library Board of Trustees, separate from the Board of Selectmen.

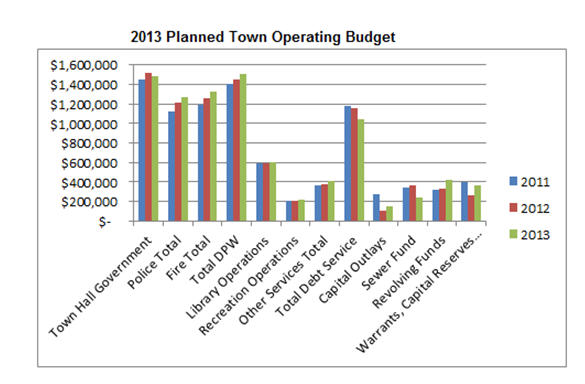

Some of the components of the town government budgets have fluctuated each year for the past three years, as indicated in Chart below.

Rye Schools.

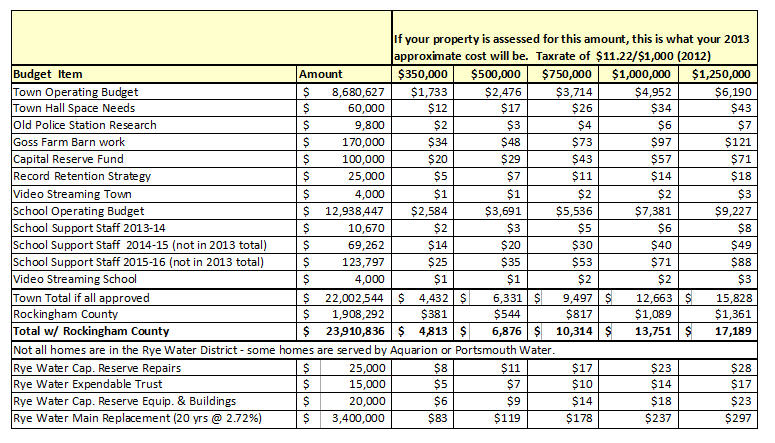

The Rye school expense represents the majority of the investment Rye residents make in local government each year. The school budget was just under thirteen million dollars ($13,000,000) for 2013 while the town government functions totaled approximately eight million seven hundred thousand ($8,700,000).

The Rye School Board is simultaneously responsible for establishing the School Budget, subject to the review and recommendation of the Budget Committee. The State of New Hampshire requires communities to show what they would provide to the State if there were Donor towns. Rye shows what we would provide to the State, but currently no Rye town taxes are sent to the State of New Hampshire. All taxes collected for the Schools stays in Rye. The Town Tax collection system obtains the funds for the schools and allocates them to the School Board to utilize.

District Wide costs are shared across the Rye Elementary School and Rye Junior High School and are the largest component of the school budget. Most of the District Costs are from total benefits, SAU costs, busing, debt payment and technology investments. High School costs are not controllable by Rye as the cost per student is dictated to the town from Portsmouth High School and the number of students going to Portsmouth High School fluctuates each year.

Rye Elementary School and Rye Junior High School costs have been stable over the past few years, as indicated in Chart B below.

The same procedure is followed for the Rye School District and the two Beach District budget requests.

The operating budget for the Town is presented to Rye’s voters at the annual Deliberative Session in a Warrant Article whose wording is prescribed by RSA 40:13 XI(c). Any registered voter can offer amendments to the proposed budget amount at that time. Those individual amendments, as reflected in the new proposed budget amount, may be approved or defeated by a majority vote of those present.

The operating budget amount finalized at the Deliberative Session is what is placed the ballot for the March vote. That budget cannot be more than 10% higher than the amount approved by the Budget Committee [not including bonded debt Articles]. If the budget is defeated at the polls, the default budget will serve as the operating budget for the year which means the amount of appropriations contained in the operating budget for the prior year, increased by debt service, contracts, and other outstanding obligations previously incurred and decreased by one-time expenditures contained in the operating budget.

Each year, the Selectmen, Town Finance Director and Town Administrator are required to calculate and disclose the default budget total and how it was derived, prior to presenting the Budget Committee’s proposed operating budget for voter approval. Thus, voters will be able to view both the proposed operating budget and the default budget.

Tax Rate Calculation.

Every property holder is Rye is subject to the Town, School and County taxes but for those in the Rye Water District, Jenness Beach Village District or the Rye Beach Village District there are additional taxes.

Rockingham County:

For many residents, the County Tax represents 9.5% of their tax bill. If you pay $8,000 in property taxes you are contributing nearly $800 each year for County Government. Our State Representatives are our representatives to Rockingham County government. There are County commissions meetings, open to the public, every other year. If agenda and meeting minutes are available they are not easily found.

Rye Water District:

Not everyone in Rye is in the Rye Water District. Houses near Portsmouth are on Portsmouth water and other houses near North Hampton are served by Aquarion water. The Rye Tax collection includes the tax for the infrastructure investments of Rye Water. Homes are also issued individual water use charges that are volume based.

Rye Beach Village District:

Rye Beach District raises funds through property taxes to fund operations that are under the district only and are not subject to the Board of Selectman. Rye Beach Village District also receives revenue from the US Postal Services for the use of the Rye Beach Post Office that is owned by the Rye Beach Village District. This District has a representative on the Budget Committee.

Jenness Beach Village District:

Jenness Beach Village District also collects taxes by the town which are allocated and spent under the control of the Jenness Beach Village District.

Chart C below shows how the rates for 2012 are distributed.

Chart C

Once a budget is approved by the voters, the Board of Selectmen has the ability to move funds within the budget, so long as the total approved budget amount is not exceeded. That is why the Budget Committee presents a bottom-line figure for the operating budget, rather than specific line-item recommendations, although the Committee reviews every budget line item in every departmental budget and at the Town Budget level before submission of the budget to the voters.

A significant part of our town government rate currently relates to debt services for our capital investments. The chart below shows that as old debt is paid off, the town can assume new debt while attempting to minimize sharp increases on the total tax burden for each resident. The process of spreading out this capital improvements budgeting is monitored by the Capital Improvements Plan Committee (CIP).